Finvar is a financial technology company on a mission to empower financial success in a more digital world for all. Wealth creation, work & financial inclusion can be exponentially enhanced by better harnessing digital assets & technology such as big data, automation, A.I, payments & cryptocurrency. Digitization is an unstoppable global trend. To remain competitive and avoid getting left behind, it is essential to effectively leverage the innovation it produces.

We build highly accessible digital infrastructure & applications that empower digital finance for organizations & individuals everywhere and at all stages of growth. An example of a product is Capnote, an AI-powered platform for financial data processing & workflow automation. It is available on a white-label or custom basis and is used by organizations & individuals to generate financial intelligence from big data, save time & cost or earn more income by monetizing digital assets. Click below to learn more.

Problems We Help Solve

There are many reasons why financial organizations do not have a great track record when it comes to building technological products. According to McKinsey, “Only 30% of banks that have undergone a digital transformation report successfully implementing their digital strategy…but technology-focused companies typically fare better.”

Finvar creates custom operating systems and tools which can be leveraged on a private-label basis to accelerate digitization and run market tests that will save tons of cost and time when compared to building proprietary technology.

Source: Softjourn, McKinsey

Problems We Help Solve

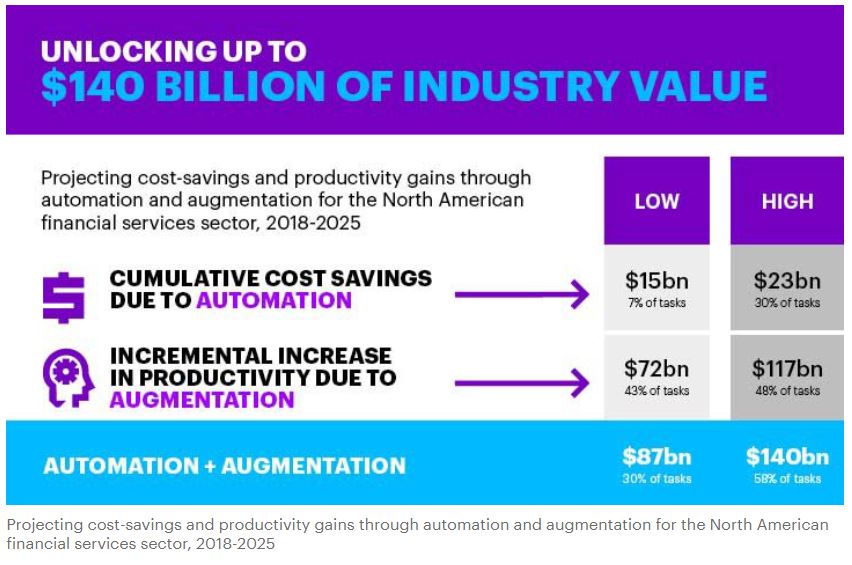

Increasing the productivity of information is key to both top and bottom line. For example, Accenture estimates $140 billion of gains and cost savings by 2025 in the North America financial services sector.

These synergies come from using better workforce technology for automation and augmentation. Finvar aims to help individuals and organizations across the world tap into these benefits.

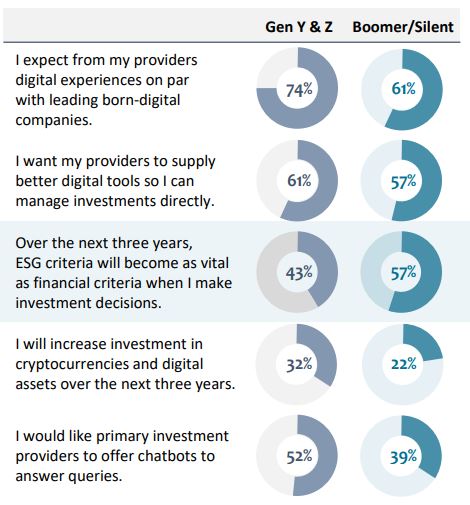

Source: Deloitte, ThoughtLabs Report – Building A Future Ready Investment Firm

Problems We Help Solve

Accenture estimates significant gains and cost savings, $140 billion, for the financial services industry in North America from implementing more advanced workforce technology for automation and augmentation. Naturally, this also applies across the rest of the world too.

Finvar uses patented technology & AI to automate financial workflows and augment financial expertise. This can generate synergies that boost both top line and bottom line by reducing costs and increasing the discovery of revenue generating opportunities.

Source: Accenture Report, Workforce 2025: Financial Services Skills & Roles