Launch and scale high-return financial solutions with fully managed, white-label infrastructure that accelerates delivery and reduces risk.

With Partnership and Insights from

Financial institutions are facing unprecedented pressure. More data, stricter regulation, rising customer expectations, and faster competitors.

Financial organizations now process massive volumes data. Legacy systems weren’t designed for this scale leading to inefficiencies and delayed decision making.

Regulations evolve constantly. Manual processes and fragmented systems increase operational risk, slow innovation, and expose organizations to costly errors.

Fintechs and digital-first players launch faster, iterate quicker, and adapt in real time. Traditional development cycles can’t keep pace.

When embedded at the infrastructure level, AI improves decision-making, automates workflows, and unlocks insights, without adding complexity.

As data volumes grow, regulations tighten, and customer expectations rise, traditional financial infrastructure becomes a bottleneck rather than an enabler.

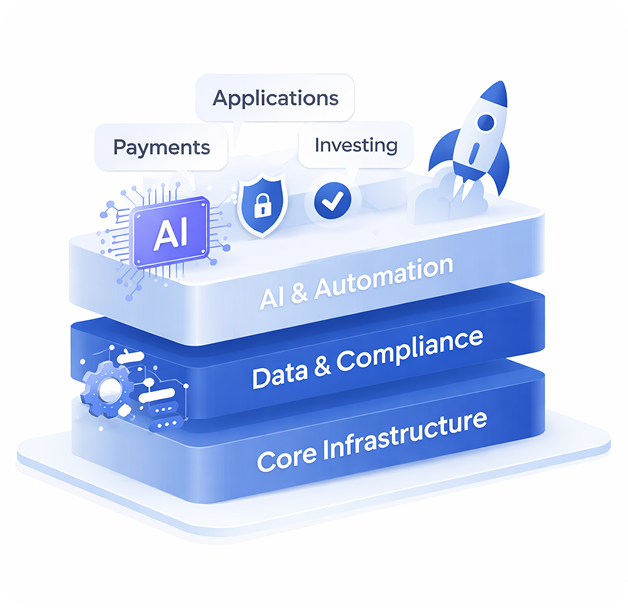

We believe the future of finance will be built on intelligent, modular infrastructure; where AI operates behind the scenes, workflows are automated by design, and compliance is embedded, not bolted on.

An AI-powered platform for building, managing, and scaling modern financial products.

Built on Finvar’s core infrastructure, Capnote embeds AI, compliance, and operational controls directly into your financial processes so teams can move faster without sacrificing security or trust.

Finvar supports different financial use cases with a flexible, infrastructure-first approach.

Finvar enables fintech teams to build, automate, and scale AI-powered financial products on secure, compliant infrastructure.

Finvar modernizes financial infrastructure by embedding AI, automation, and compliance into existing systems.

Finvar centralizes financial data, automates reporting, and surfaces actionable insights — allowing teams to focus on decisions.

Finvar supports managed deployments and customer-controlled environments, with a clear path to ownership for organizations that require full control.

Regulatory requirements and operational safeguards are built directly into the infrastructure reducing risk as products grow.

Aggregate, structure, and manage large volumes of financial data across systems built for reliability, auditability, and scale.

Automate complex financial workflows and apply AI-driven analysis to surface insights, detect anomalies, and improve efficiency.

“10% of tasks in the financial services workforce could be automated by 2025, while 48% could be augmented with technology. Cost savings & productivity gains could deliver up to $140 billion of cumulative value for the North American financial services industry…”

Name

Accenture

” I was drawn to Capnote by its ability to automate data-driven financial workflows. My investment banking team was able to try it at a reasonable rate and found significant benefits for productivity and time saving.”

Chidi (Head of Investment Banking)

Rand Merchant Bank

“As an independent financial advisor, I found Capnote to be an effective and cutting-edge digital experience for my clients. I particularly liked it as a white-label platform that’s customizable. It saved me a lot of money and time.”

Michael (Managing Director)

Empowerment Wealth Advisors

Schedule a discovery call to discuss your goals, challenges, and how Finvar’s infrastructure can support your next phase of growth.

Tell us about your use case, and we’ll tailor a solution that fits your requirements, scale, and regulatory needs.